Balance Sheet Wall Street Oais Is Important

So if you re focused on the future you can check out this free report showing analyst profit forecasts.

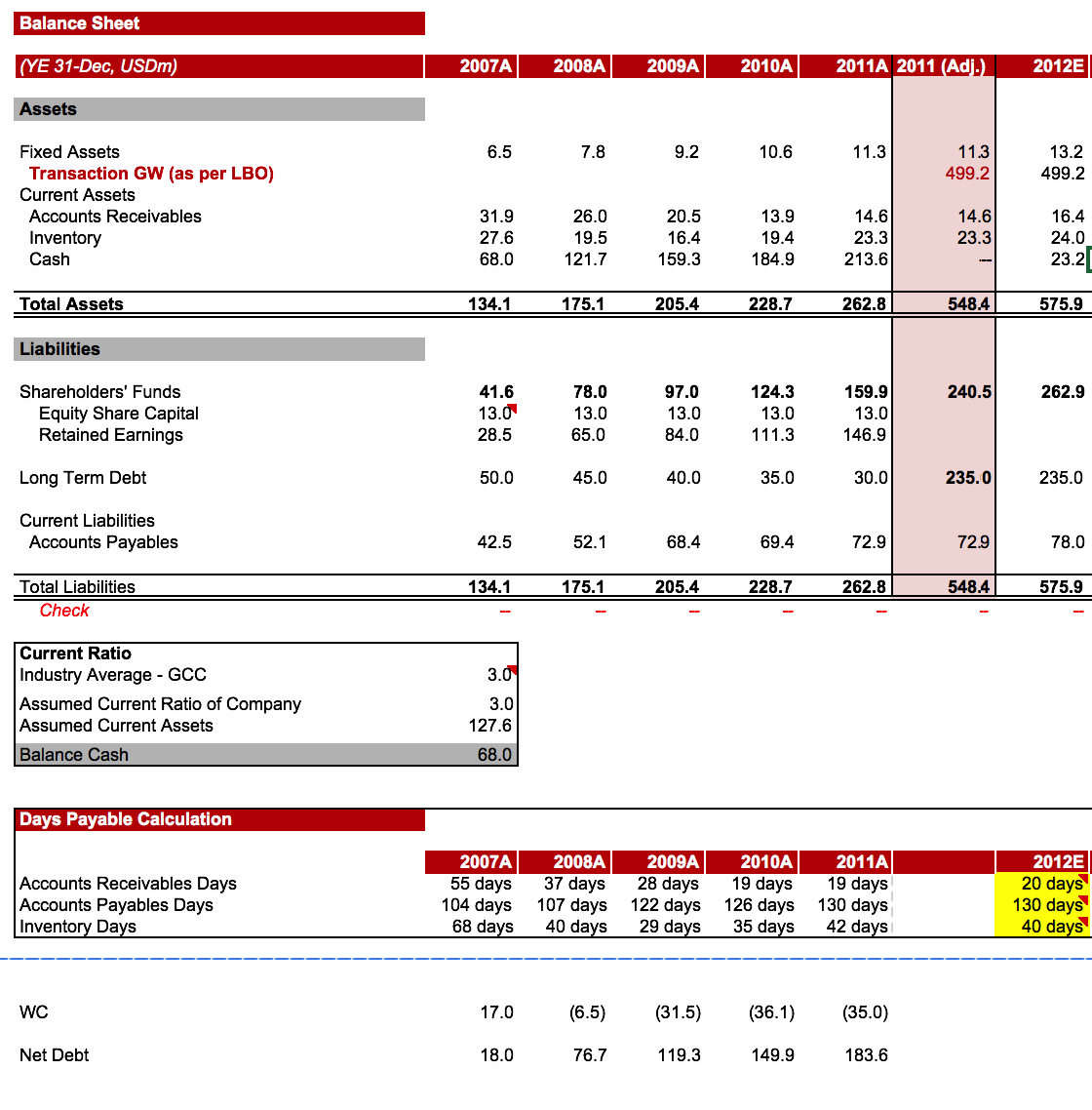

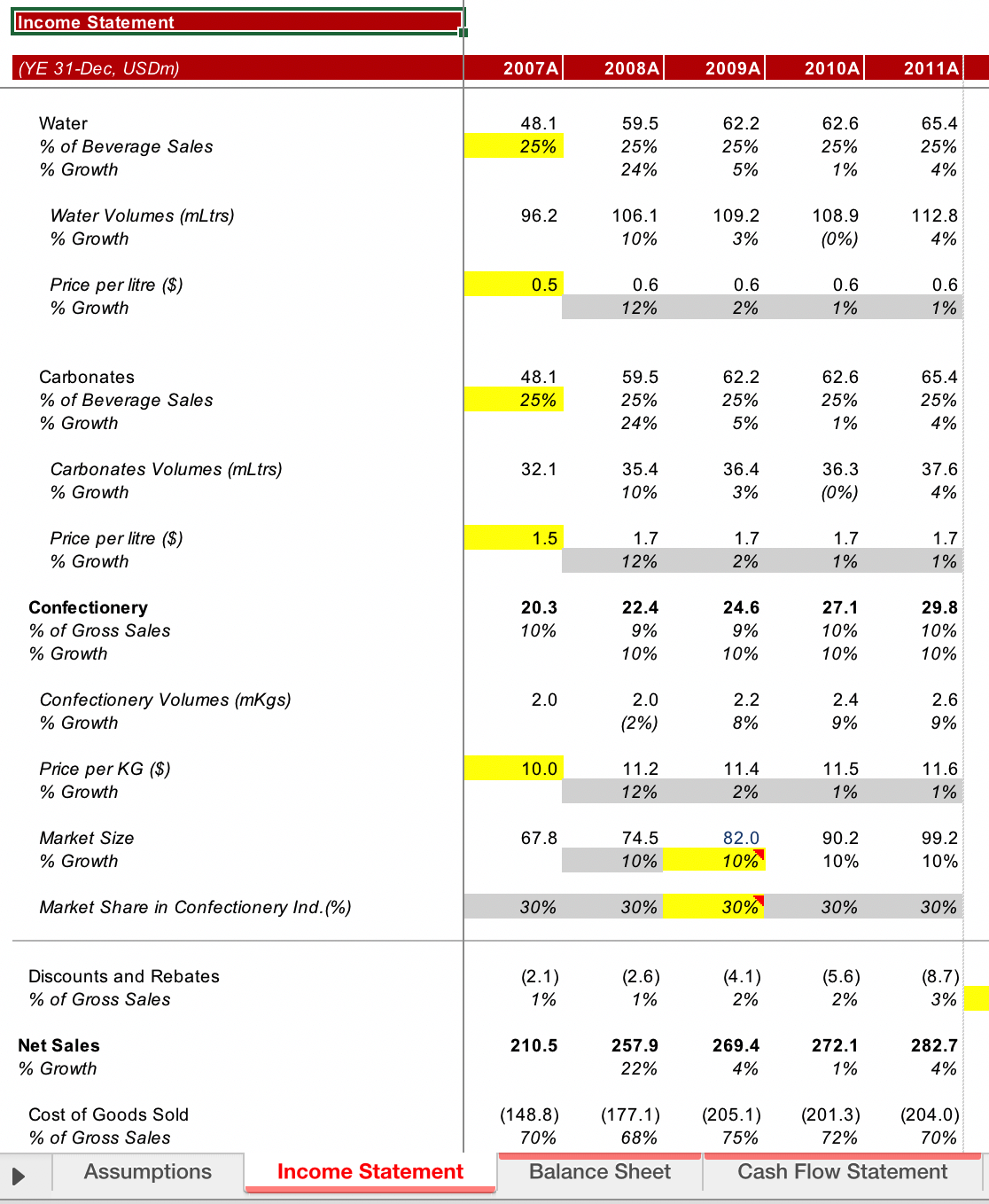

Balance sheet wall street oais is important. It is often possible to get a basic understanding of how a company is funded just by looking at the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. This is a professional balance sheet excel template used to help value a company. When facing this question the answer should be the balance sheet and the income statement because with those two filings you can create the statement of cash flows assuming that you have the prior period and current period balance sheet.

Shareholder equity is also an important financial metric in determining the return being generated versus the total amount being invested by equity investors. In large part the balance sheet is driven by the operating assumptions we make on the income statement. A strong balance sheet usually means high qualify assets including a strong cash position very little or no debt and a high amount of shareholder s equity. One of the most fundamental rules of accounting and finance is that a balance sheet must balance hence the name.

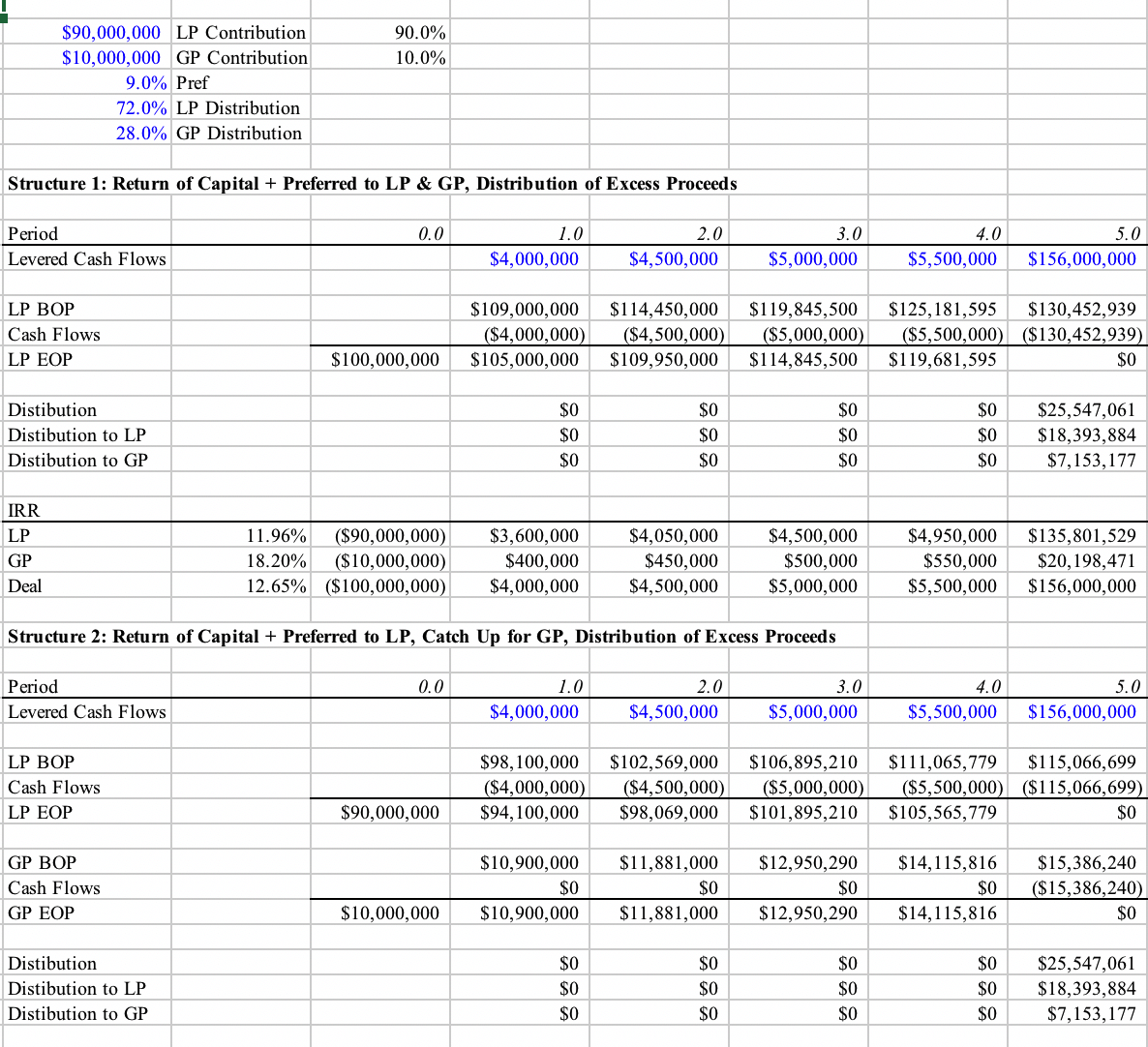

Think of the income statement as the horse and the balance sheet as the carriage. New wso financial modeling courses now available here. More importantly if you familiarise yourself with using financial ratios the balance sheet can provide warning signs so you can solve any problems before they destroy your business. Assets will always be equal to liabilities shareholder s equity.

Accordingly we decided to list some basic best practices for projecting balance sheet line items below. Revenues drive the operating assumptions in the income statement and this continues to hold true in the balance sheet. They blamed wall street for creating the financial crisis recession and resultant long term unemployment. A balance sheet shows the company s net worth.

According to the wso dictionary a balance sheet is one of the three financial statements that are used to value a company and to show what it owns or owes. Occupy wall street opposed income inequality in which the top percent of the world s population owns the majority of its wealth. The balance sheet lists all assets liabilities and shareholder s equity attributed to the company. We spend a lot of time making sure that our trainees understand the inter relationship of the balance sheet income statement and cash flow statement because it is so vital to properly understanding these models.

The balance sheet is a vital financial statement you should be reviewing regularly as it changes with every transaction. The balance sheet is one of three important financial statements intended to give investors a window into company s financial condition at a specific point in time. This is wall street oasis shareholder s equity template for calculating net worth. Revenue and operating forecasts drive working capital items capital expenditures and a variety of other items.